Capital Weighted Volume

Capital Weighted Volume is based on the work of Buff Dormeier, CMT. This tool calculates the total volume and also the upside (advancing) and downside (declining) volume on a daily basis, weighted by the market capitalizations of the index members.

NOTE: this indicator is only available for clients with the Optuma Breadth Data enabled on their account. At this time only the capital weighted volume has been calculated for the S&P500 Index (SPX), but more will added in the future.

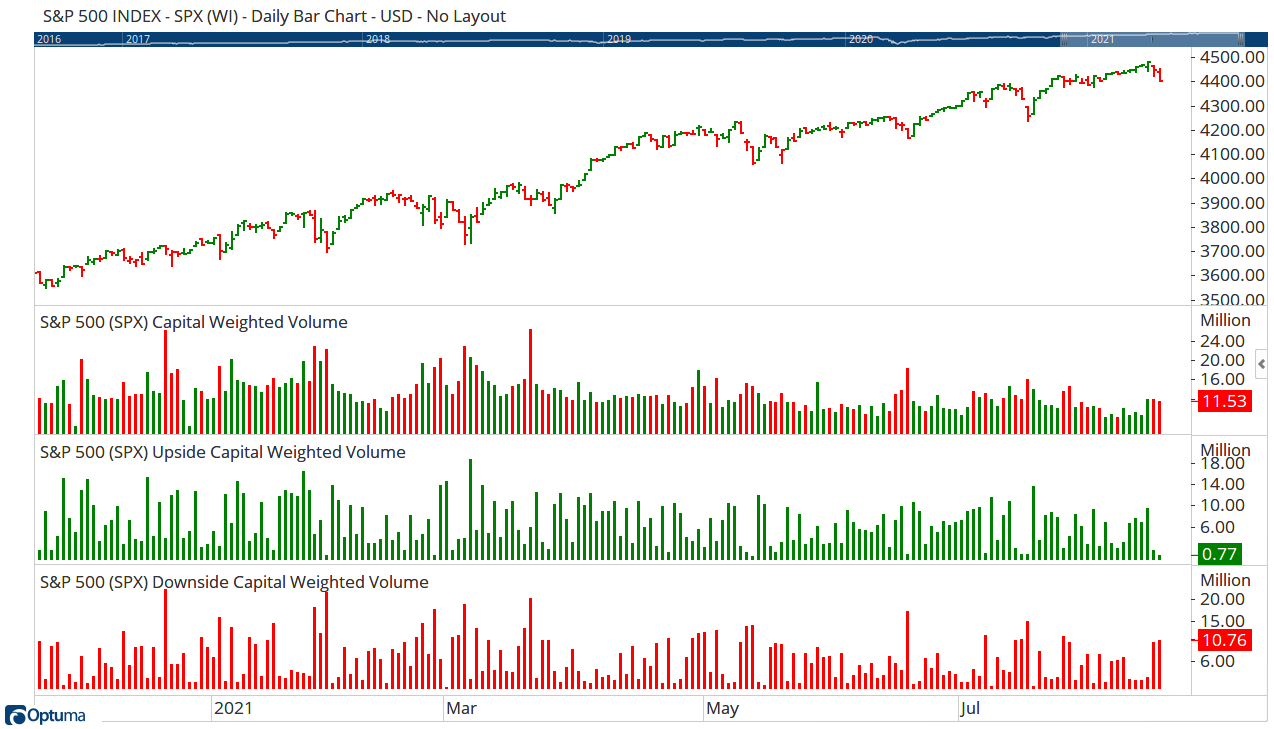

In this example, the total Capital Weighted Volume for the last day was 11.5 million, of which only 0.8 million was for advancing members, versus 10.8 million for declining members.

When set to display the Accumulated Capital Weighted Volume, the tool calculates adds the daily net value to the day before, similar to an Advance/Decline Line. As such, following on from the above example the current value of the accumulation data has declined by -9.99 million (0.77 - 10.76):

Scripting Function: CWV()

Net Change: CWV(CWPLOT=Upside Capital Weighted Volume) - CWV(CWPLOT=Downside Capital Weighted Volume)

</span>

Actions & Properties

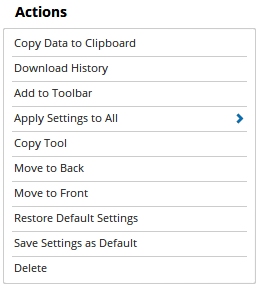

Actions

Copy Data to Clipboard: Will copy the tool’s values to the clipboard which can then be inserted into a spreadsheet, for example, allowing for further analysis.

Copy Data to Clipboard: Will copy the tool’s values to the clipboard which can then be inserted into a spreadsheet, for example, allowing for further analysis.

Download History: If the data doesn’t download automatically click here to manually force the download.

Add to Toolbar: Adds the selected tool to your custom toolbar.

Apply Settings to All: When multiple CWV tools have been applied to a chart, page or workbook, this action can be used to apply the settings of the one selected to other instances of the tool. This is a great time saver if an adjustment is made to the tool - such as line colour - as this allows all the other CWV tools in the chart, page or entire workbook to be updated instantly.

Copy Tool: Allows you to copy the selected tool, which can then be pasted onto a different chart window.

Move to Back: If the tool is displaying in front of other tools or indicators clicking this action will move the tool view to the background.

Move to Front: If the tool is displaying behind other tools or indicators on the chart, clicking this action will bring the tool to the forefront.

Restore Default Settings: Click this action if you have adjusted the default settings of the tool, and wish to return to the standard properties originally installed with Optuma.

Save Settings as Default: If you have adjusted any of the tool’s properties (colour, for example) you can save the adjustments as your new default setting. Each time you apply a new CWV to a chart, the tool will display using the new settings.

Delete: Deletes the tool from the chart.

Properties

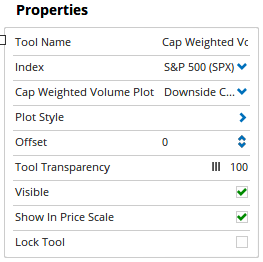

Tool Name: Allows you to adjust the name of the tool, as it’s displayed in the Structure Panel.

Tool Name: Allows you to adjust the name of the tool, as it’s displayed in the Structure Panel.

Index: Select the index to be used (currently only S&P500 is available).

Cap Weighted Volume Plot: Four outputs available:

- Capital Weighted Volume

- Upside Capital Weighted Volume

- Downside Capital Weighted Volume

-

Accumulated Capital Weighted Volume

Plot Style: Choose the display style (eg Histogram, Line, etc) and colour.

Offset: Moves the tool forward or backwards in time. The offset is measured in bars, so a value of 2 will push the tool forward 2 bars and -2 will move the tool back 2 bars.

Tool Transparency: Use this slider bar to adjust the transparency of the tool. Moving the slider to the left will increase the transparency of the tool.

Visible: Un-tick this checkbox to hide the tool from the chart.

Show in Price Scale: When selected, the current CWV value will be displayed in the Price Scale.

Lock Tool: When selected, any changes to the tool will be prevented from being made.