Total Return Function - TRET()

Overview

The TRET() function converts the historical prices in to Total Return data (i.e. adjusting prices for dividend or coupon payouts).

Note

The TRET() function will only work when the chart / watchlist is set to show Price Returns - if set to Total Returns then it is not required.

Examples

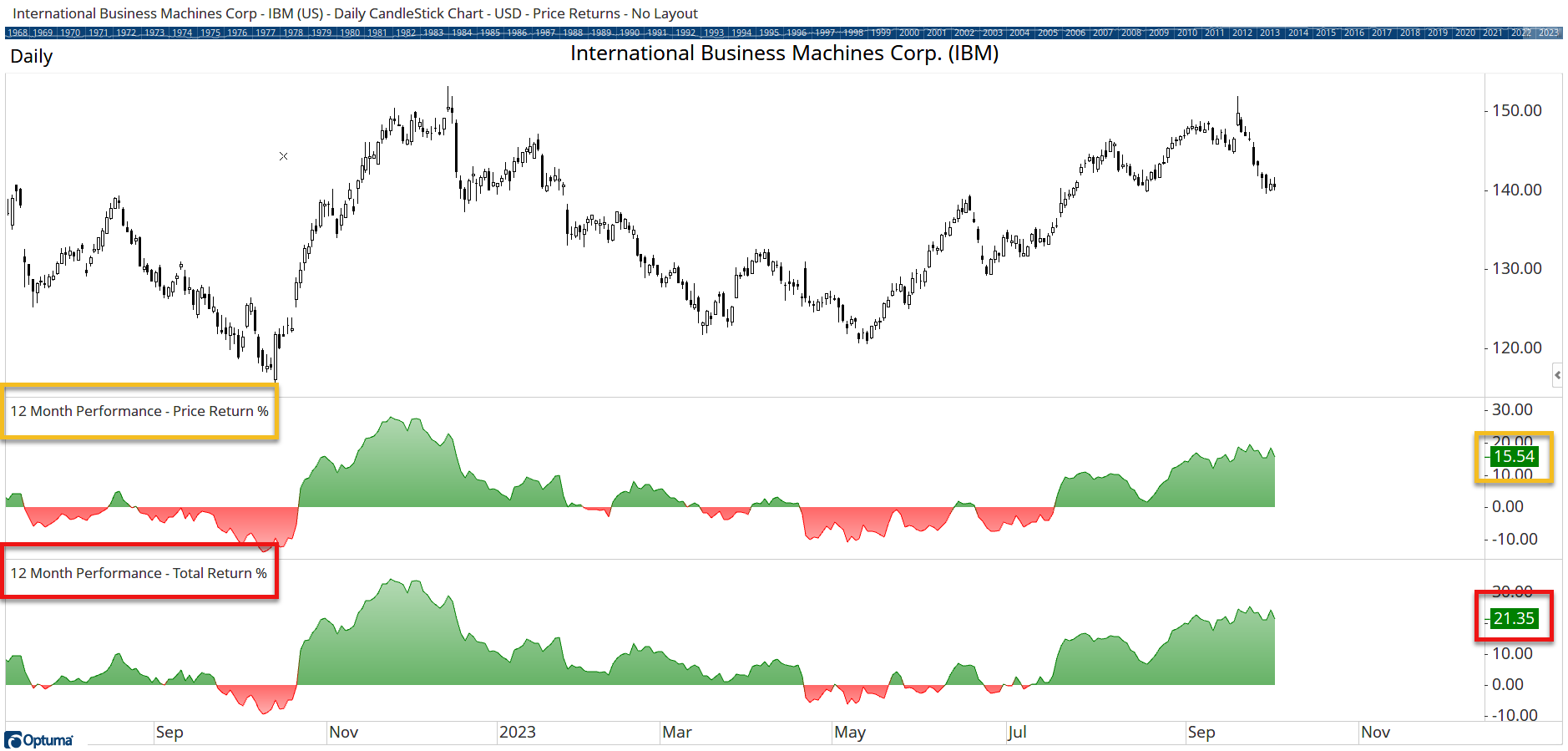

In this example the Show View is using the following formula to show the 12 month Total Return below the 12 month Price Return for IBM:

//Convert data to Total Return;

TR1 = TRET(CLOSE());

//12 month change of TR data;

CHANGE(TR1,INT_COUNT=12, INT_TYPE=Month)

On a price Retrn basis, IBM has gained 15.54% over the last 12 months, but when taking in to account dividend payouts the Total Return has increased to 21.35%.