Correlation Function - CRL()

To calculate correlations between a stocks, asset classes or sectors use the CRL() function.

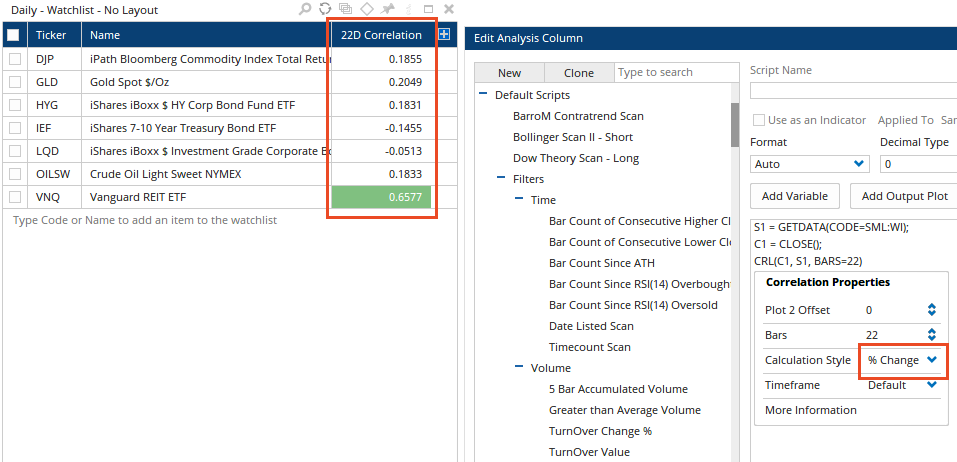

For example, to show the 22 day correlation between the S&P500 index and various asset classes use the following in a watchlist with the GETDATA() function to use the SPX data:

S1 = GETDATA(CODE=SPX:WI);

C1 = CLOSE();

CRL(C1, S1, BARS=22)

By default it will calculate based on % change, but it can also be calculated on price change.