How to Create a Custom Index

An easy way to create a custom index of a basket of stocks, or portfolio, is to simply add them together in...

Details on the latest quarterly rebalance of the S&P indices for the ASX & US.

Monday, March 20, 2023 sees the quarterly rebalancing of the major S&P indices. Included in the update are the Australian ASX200 ($XJO), ASX300, and in the USA the S&P500 ($SPX), S&P400, and S&P600 indices.

If you have access to the Optuma Symbol lists, the members of the indices will automatically update for you. Any scan or watchlist you have linked to the symbol list will use the new membership.

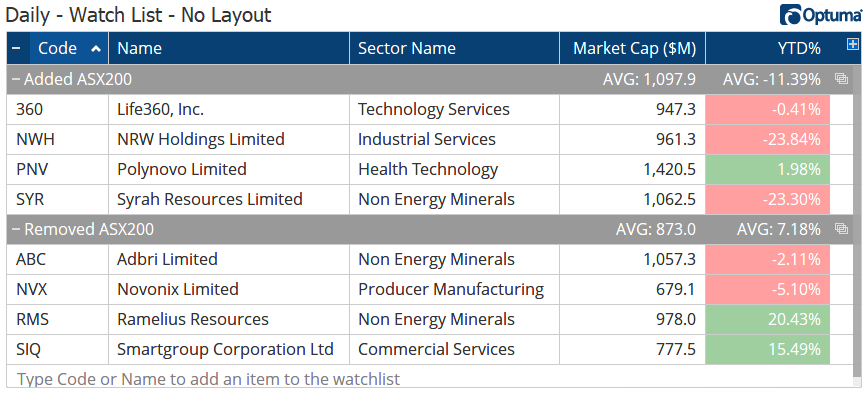

Four changes have been made to the top 200 Australian companies, with one change to the ASX20 (South32 $S32 replaces James Hardie $JHX). The watchlist below shows the changes in the ASX200. It’s interesting to note the four added have all been in the index before - in fact Life360 was only removed last September - and so far this year have, on average, significantly underperformed those they are replacing:

A list of the ASX 200 Changes in March 2023

A list of the ASX 200 Changes in March 2023

There was only one change to the U.S. S&P500 based on rebalancing, but there were two other changes this week following the collapse of Silicon Valley Bank ($SIVB) and Signature Bank ($SBNY).

For the rebalancing, Fair Isaac & Co ($FICO) replaced Lumen Technologies ($LUMN) which is the worst-performing member of the index this year, down 80% from its one-year high.

The two banks were replaced on March 15th by healthcare company Insulet ($PODD) and Bunge ($BG), an agribusiness company.

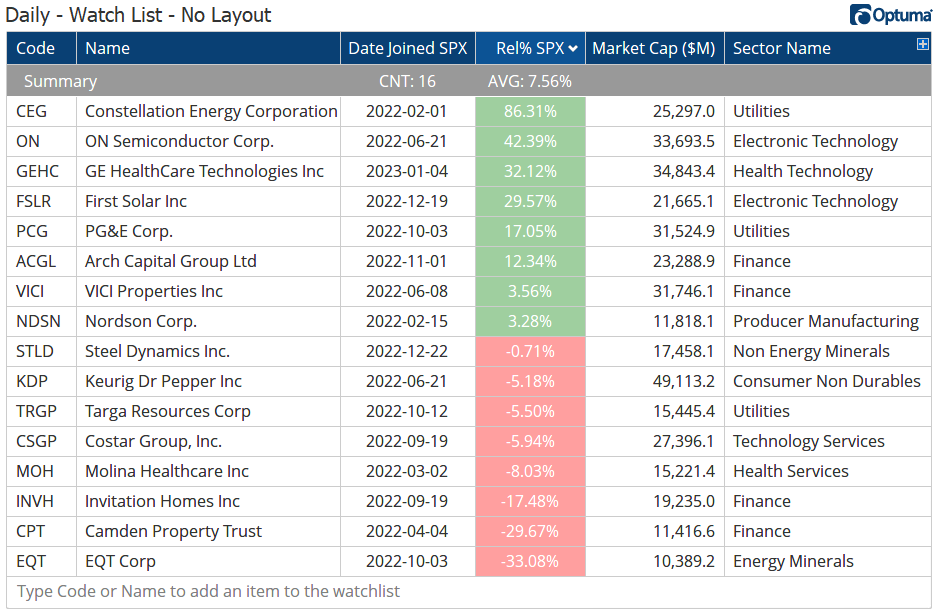

Before these recent changes there were 16 companies that joined the S&P500 since the beginning of 2022. The watchlist below uses a couple of simple scripts to display the date they joined and the relative performance versus the index since the day they joined:

A list of the SPX Additions in 2022

A list of the SPX Additions in 2022

1

2

3

V1=ISMEMBER(SYMBOLLIST=S&P 500) ChangeTo 1;

D1=BARDATE();

VALUEWHEN(D1, V1==1)

1

2

3

4

V1=ISMEMBER(SYMBOLLIST=S&P 500) ChangeTo 1;

D1=BARDATE();

$D2=VALUEWHEN(D1, V1[-1]==1);

RIC(DATESEL=User Defined, START_DATE=$D2, ZEROBASED=True)/100

On average they have outperformed the index by 7.5%, with Constellation Energy $CEG beating the index by 86% since it was added to the index in February 2022. The worst performer has been $EQT which was added in October and is down 33% since then on a relative basis.

Whilst being added to the index is by no means a guarantee of success (see this article for more index membership analysis) it makes sense those being added to the index as a result of rebalancing are likely to perform better than those being removed (usually for poor performance).

If we take the case of this rebalance with $FICO replacing $LUMN you can see in the charts below how the two have fared over the last year, $FICO gaining 42% and $LUMN losing 77%. The weekly Relative Rotation Graph® in the bottom-right shows $LUMN started to lag the S&P500 index when it crossed into the red quadrant in early September 2022, with $FICO joining the Leading green quadrant in July (to learn more about RRGs see here).

Charts comparing the performance of $FICO vs $LUMN

Charts comparing the performance of $FICO vs $LUMN

When testing on our S&P500 historical data, $LUMN will be included in the results up to this week, with $FICO only included from this coming Monday. The concept of testing on historical index members is discussed in detail in Mathew Verdouw’s article on the importance of Survivorship Bias-free data.

Get blog updates and Optuma News