ASX and S&P500 Sector Workbooks

This week saw the quarterly rebalancing in the ASX200 and S&P500 indices. Optuma clients can download and o...

Use the Gap Finder tool in Optuma 2 to help identify trading opportunities.

Gaps are one of the most important tools we have as Technical Analysts. When a significant gap happens in the opposite direction to the trend, that breakaway is telling us that the trend is most likely changing. When we see a gap in the middle of a move, then it is like someone poured fuel on the fire. The question then is if the trend is sustained, or if the gap gets filled.

Gaps are said to be filled when price quickly runs out of steam and retraces back to fill the prices that were skipped by the gap.

It’s important for us to know when gaps occur and how quickly they get filled. This is where the Optuma 2.0 Gap Finder comes in.

Before, the way to show gaps was by using a simple script in a watchlist or chart using a simple formula:

LOW() > HIGH()[1];HIGH() < LOW()[1]; Gaps

Gaps

This is useful, but the Gap Finder tool draws a shaded area on a chart to help visualise the gap zones on the chart.

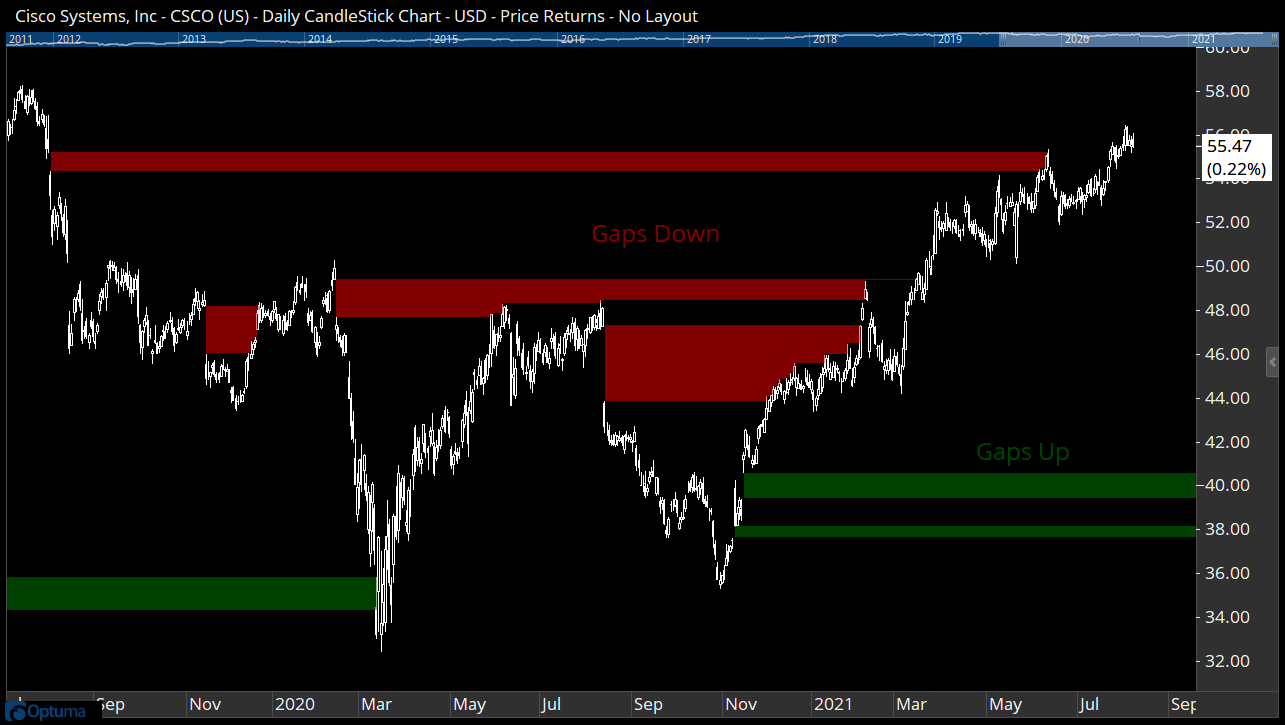

In this example, two green breakaway gaps last November identified the start of a new trend in CSCO, which filled three previous gaps down (in red), the first of which occurred back in July 2019:

Gap Finder

Gap Finder

Like most of our tools, the properties can be adjusted to suit your needs, such as the percentage size of the gap, and whether partially-filled gaps should be included. Also, if the gap gets filled within a certain timeframe (20 days by default) then it will have failed, and be ignored.

The GAP() function in scripting has four output values, allowing you to search for any conditions:

GapAbove - Price of the beginning of the next gap zone above.

GapBelow - Price of the beginning of the next gap below.

GapAboveSize - the width of the zone above (in $).

GapBelowSize - the width of the zone below (in $).

For example, to show how far in percent the current price action is above a gap below - based on a 0.5% gap - you would use this:

1

2

G1=GAP(MINSIZE=0.50);

(CLOSE() - G1.GapBelow) / G1.GapBelow * 100

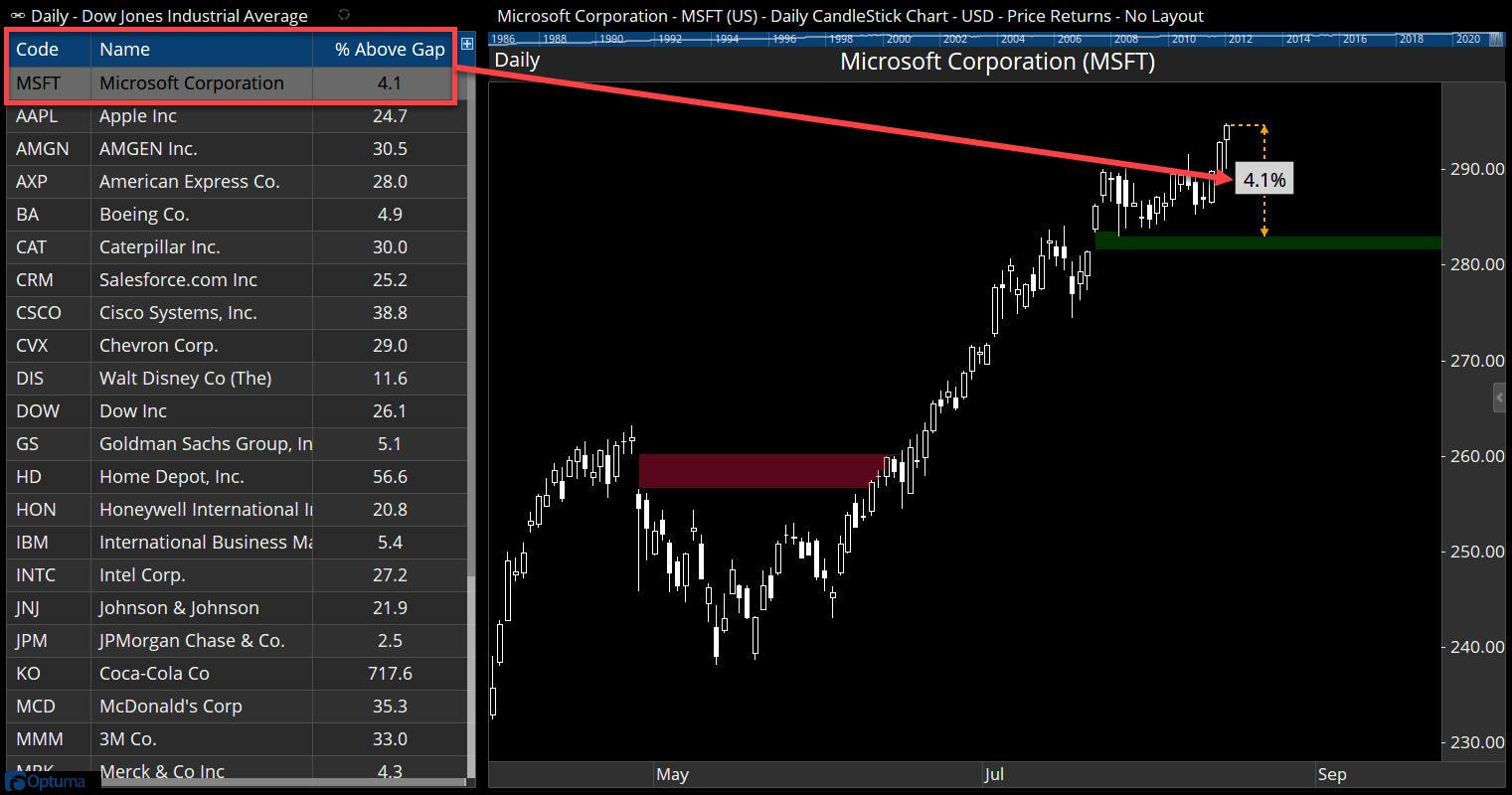

Microsoft is currently 4.1% above the partially-filled recent gap, and moving away:

Scripting

Scripting

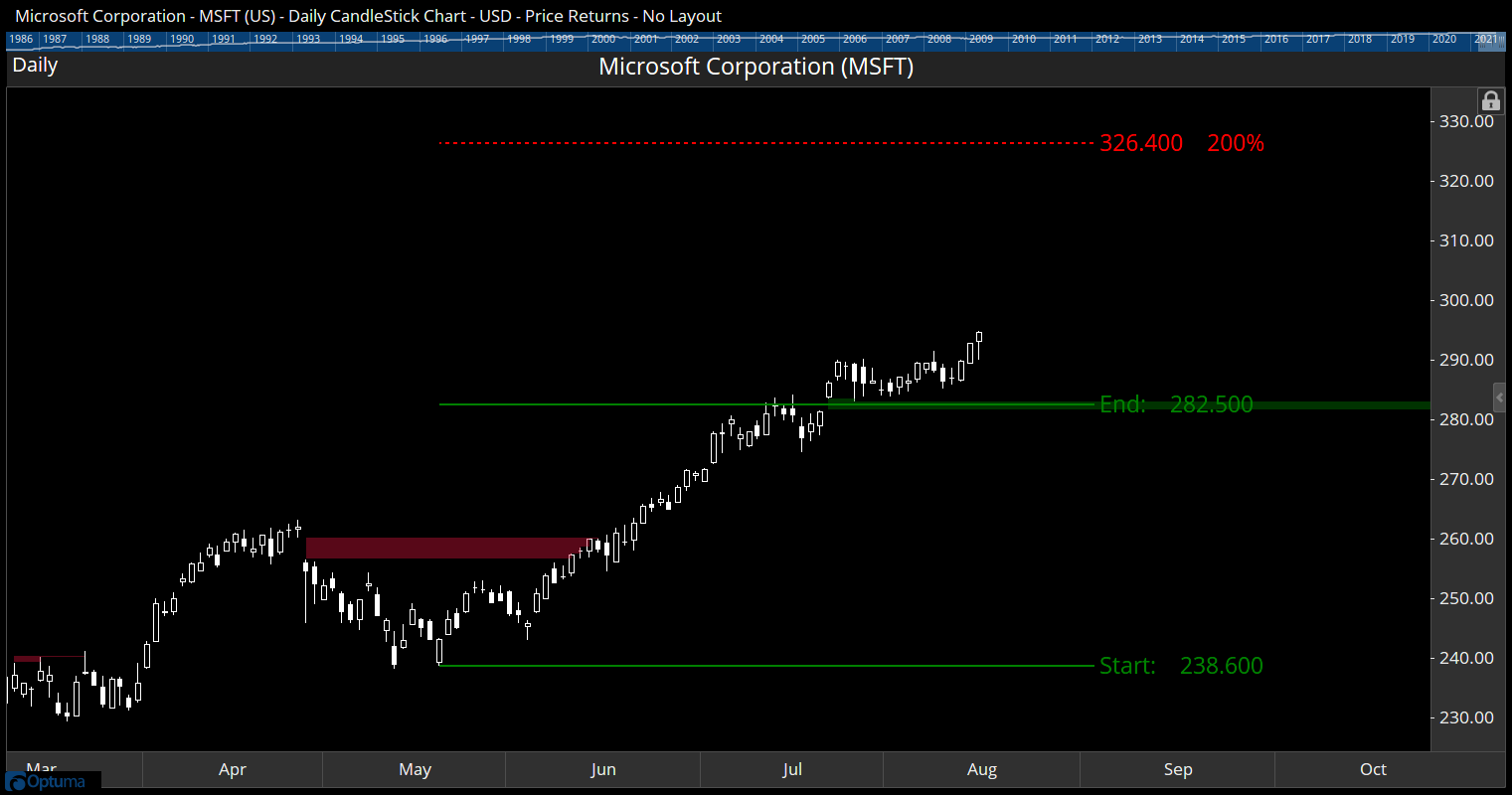

In fact, as this gap occurred in a strong trend it could be a potential runaway gap, giving a price target of $326 as measured from the low to the middle of the gap. Of course, if the gap gets filled in the coming days then it could be an exhaustion gap, so one to keep an eye on!

Runaway Gap

Runaway Gap

The Gap Finder tool is available in Optuma 2 which is currently in beta testing. Contact Optuma support if you would like access to it now.

Get blog updates and Optuma News