ASX and S&P500 Sector Workbooks

This week saw the quarterly rebalancing in the ASX200 and S&P500 indices. Optuma clients can download and o...

A quick look at the performance of this year's IPOs on the Australian and US markets. Optuma clients can download and open the workbook and add their own analyses.

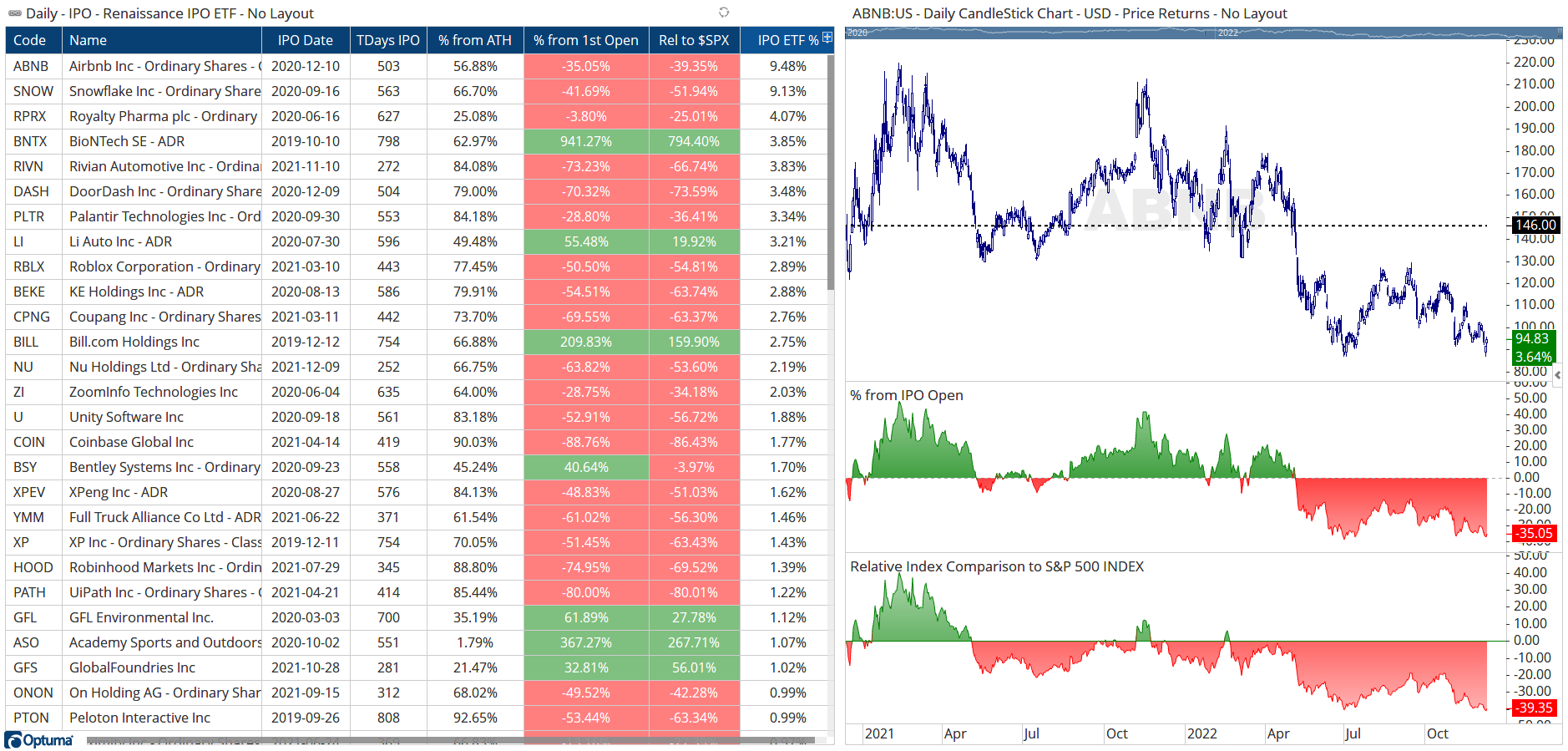

2022 has been rather a quiet year for US IPOs, with the number of new listings being down over 80% from last year. Of the 76 new listings - not including Special Purpose Acquisition Companies (SPACs) - as of December 8th only 14 are trading above their first day opening price (not offering price). In fact, the median stock in the list is 59% below their opening price, and 75% below their all-time high.

The best performer has been Belite Bio Inc, which is currently +147% above April’s opening price, outperforming the S&P500 index by 204% since listing, but is 31% off its high.

US IPOs 2022

US IPOs 2022

Clients with US data can download the watchlist above by clicking the button below, and it will also include a tab with the statistics of the holdings of the Renaissance IPO ETF ($IPO). At 9.5%, the largest holding in the IPO is Airbnb ($ABNB) which listed almost 2 years ago. It reached a high of $220 a couple of months after listing - almost a 50% gain on its opening price of $146 - but has since slumped to below $100. Over that 2 year period, it has underperformed the $SPX index by 40%:

IPO ETF Holdings

IPO ETF Holdings

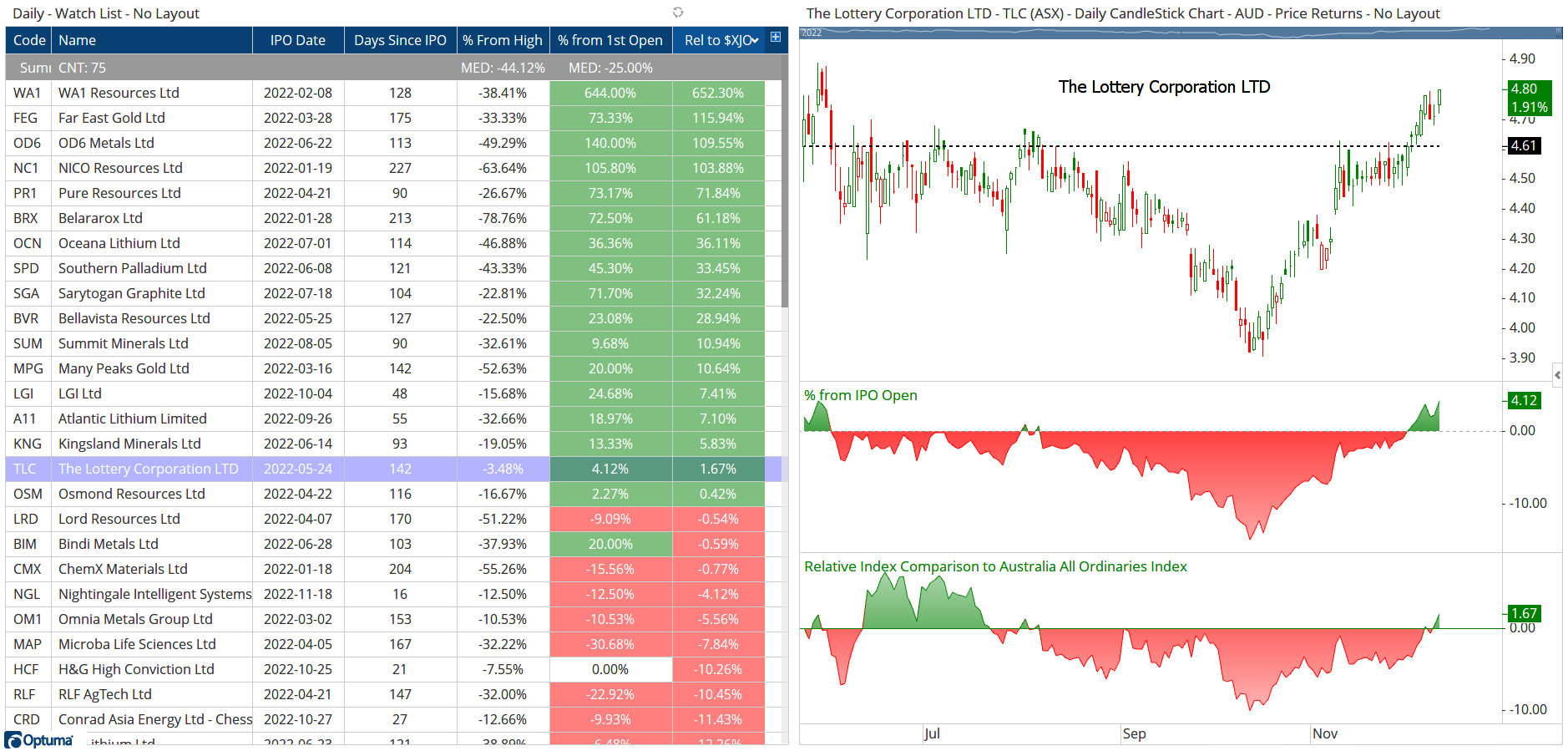

In Australia, there has been a similar number of IPOs this year - 75 - less than half of 2021. The standout performer has been WA1 Resources which started trading in February at $0.25 and did nothing until October when it jumped over 400% in one day! It’s currently at $1.86 - a 652% gain over the ASX All Ordinaries index ($XAO).

The biggest IPO of the year was The Lottery Corporation ($TLC) after its demerger from Tabcorp in May. After a brief gain, it soon fell below the opening price of $4.61, which it couldn’t break above despite several attempts. It wasn’t until a few days ago that it managed to close - and stay - above that level.

ASX - IPOs - 2022

ASX - IPOs - 2022

Clients with access to our US or ASX data can click the buttons below to save and open the workbooks. Please contact us at support@optuma.com, and if you have any queries about the formulas for the watchlist columns or tools please reply to this forum thread.

Get blog updates and Optuma News