How Professional Technical Analysts Handled the Covid-19 Crash

For the last few weeks global markets have seen periods of greater than average volatility resulting from s...

The January Barometer is an investing theory that suggests that the performance of the stock market in the month of January can be used to predict the performance of the stock market for the rest of the year. According to the theory – first posited by Yale Hirsch in 1972 - if the stock market rises in January, then it is likely to rise for the rest of the year.

The January Barometer is an investing theory that suggests that the performance of the stock market in the month of January can be used to predict the performance of the stock market for the rest of the year. According to the theory – first posited by Yale Hirsch in 1972 - if the stock market rises in January, then it is likely to rise for the rest of the year. Conversely, if the stock market falls in January, then it is likely to fall for the rest of the year. The theory is based on the idea that investors are optimistic at the start of the year and that their optimism carries over into the rest of the year.

With January 2023 gaining 6.2% - the best start to a year since 2019 - should we expect the rest of the year to be positive?

Darren Hawkins

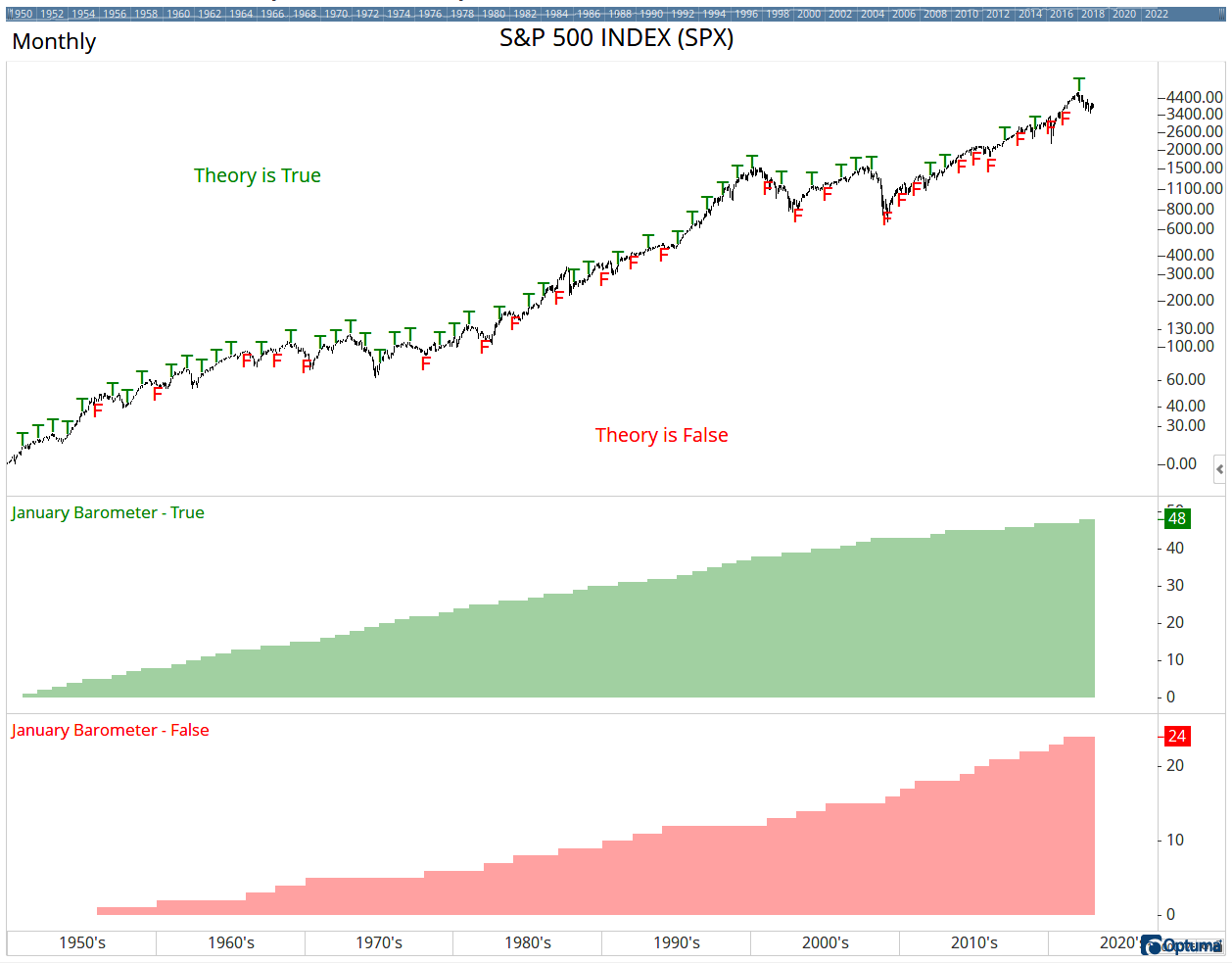

We can visualise this on a monthly chart of the S&P500 index with two Show Bar tools showing a T when the theory is true (i.e. January was positive (negative) and the index closed higher (lower) 11 months later) and an F where it failed. Last year the theory passed - the first time since 2019 - because in January the index fell -5% and the year ended negative (-19%).

The Show View indicators below the chart count the true / false events, so since 1950 the theory is twice as likely to be true (48 times versus 24). However, before 2009 the ratio was 2.9 but over the last 14 years it has only been 0.6 (5 passes versus 9 failures). Of course, we’ll have to wait another 11 months to see how this year turns out - if it fails then the pressure will really be on!

January Barometer

January Barometer

If you are interested to see how these values were calculated, the script formulas are listed at the end of the article.

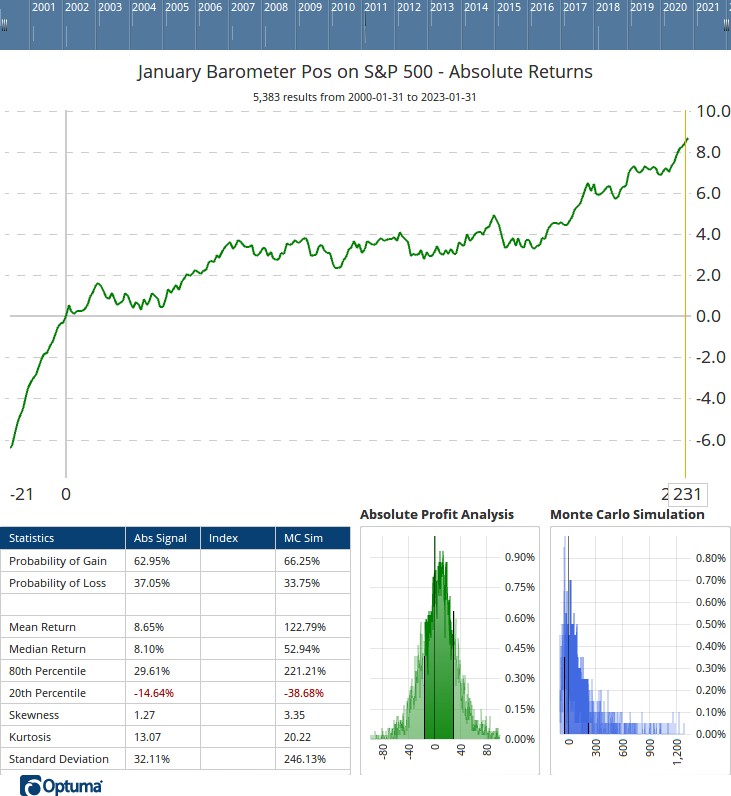

That’s OK for the index, but how do individual stocks fare? For that analysis we can use the Signal Tester. Using a script formula, we can calculate performance for the rest of the year when January performance was positive and compare it with when it was negative.

The test uses the historical membership of the S&P500 since 2000, so stocks are only included when they are in the index (for example $TSLA wasn’t considered until January 2021). These are the results of the 5,000+ events following a positive January:

Avg Returns following Positive January

Avg Returns following Positive January

Not bad! The -21 area on the left of the chart represents the average January performance (ie sloping up because it was positive), and we then measure 231 days after – approximately 11 months – to take us to the end of the year. The Probability of Gain is 63%, with a mean return from the end of January to the end of the year of 8.65%.

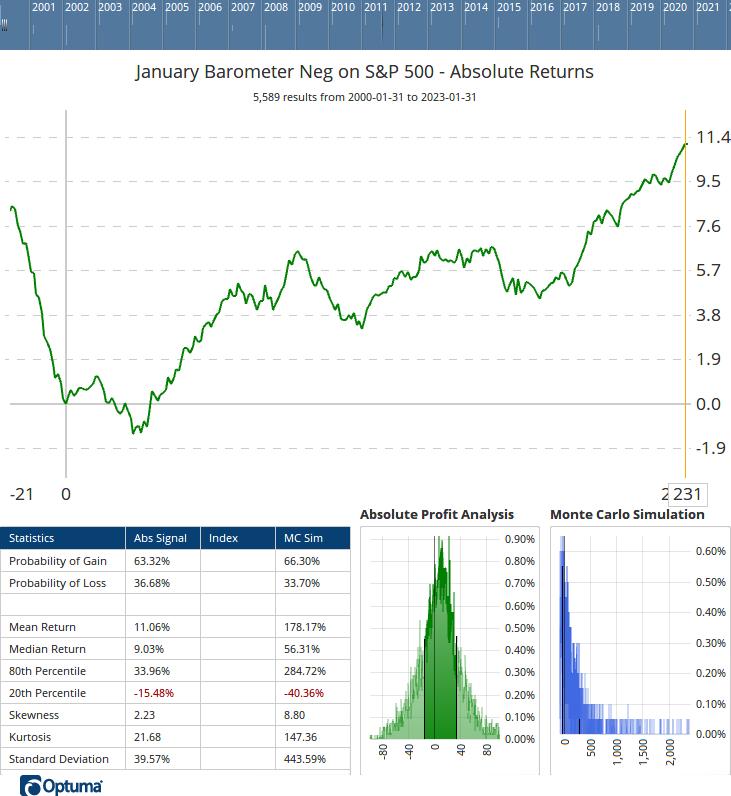

Now let’s look at when January is negative. If the barometer theory holds, you would expect that the returns for those events would also be negative, but it’s not true!

With slightly more trades and a similar Probability of Gain, those stocks closing down in January actually end the year – on average – gaining 11%! February tends to also be weak, and then performance improves in March, and especially in the 4th quarter:

Avg Returns following Negative January

Avg Returns following Negative January

This is telling us that no matter what happens in January, stocks will, on average, perform positively for the rest of the year – and even better if they are down in January! This year there were 106 members of the S&P500 index which lost value in January, including UnitedHealth ($UNH), Chevron ($CVX), Coca-Cola ($KO), and IBM ($IBM). It will be interesting to see how they fare the rest of the year.

As analysts, we need to know that our theories have a sound statistical basis. In only a few minutes, we’ve been able to test a theory and now know with certainty if it is something that we should believe or not.

1

2

3

4

5

6

7

// To display in a Show Bar set to display as text;

// Define data for January;

V1=MONTHNUM()==1;

// Calculate performance direction for January and 11 months after;

V1 and ((PERFORMANCE(PERIODAMT=1)<0 and PERFORMANCE(DIRECTION=Forward, PERIODAMT=11)<0)

or (PERFORMANCE(PERIODAMT=1)>0 and PERFORMANCE(DIRECTION=Forward, PERIODAMT=11)>0))

1

2

3

4

5

6

7

// To display in a Show Bar set to display as text;

// Define data for January;

V1=MONTHNUM()==1;

// Calculate performance direction for January and 11 months after;

V1 and ((PERFORMANCE(PERIODAMT=1)<0 and PERFORMANCE(DIRECTION=Forward, PERIODAMT=11)>0)

or (PERFORMANCE(PERIODAMT=1)>0 and PERFORMANCE(DIRECTION=Forward, PERIODAMT=11)<0))

Take the above formulas and wrap the result in an ACC() accumulation function in a Show View.

1

2

3

4

5

6

7

8

// Get monthly data;

M1 = MONTH();

// Signal when month changes to Feb, and Jan is up for historical index members only;

V1 = MONTHNUM() ChangeTo 2 and M1[1] IsUp and IsMember();

// offset by -1 to get the January close;

V1[-1]

1

2

3

4

5

6

7

8

// Get monthly data;

M1 = MONTH();

// Signal when month changes to Feb, and Jan is down for historical index members only;

V1 = MONTHNUM() ChangeTo 2 and M1[1] IsDown and IsMember();

// offset by -1 to get the January close;

v1[-1]

Get blog updates and Optuma News