Catching a Falling Knife

So far in this series, we’ve been looking at long term general market conditions with an overall bullish se...

Many analysts are crying that the markets are overextended. Are they? An accidental look at previous recoveries may tell a different story.

We’re always working on new ideas at Optuma. Most of the ideas are great, and sometimes….. well let’s just forget about the chart navigation joystick of Market Analyst 5!

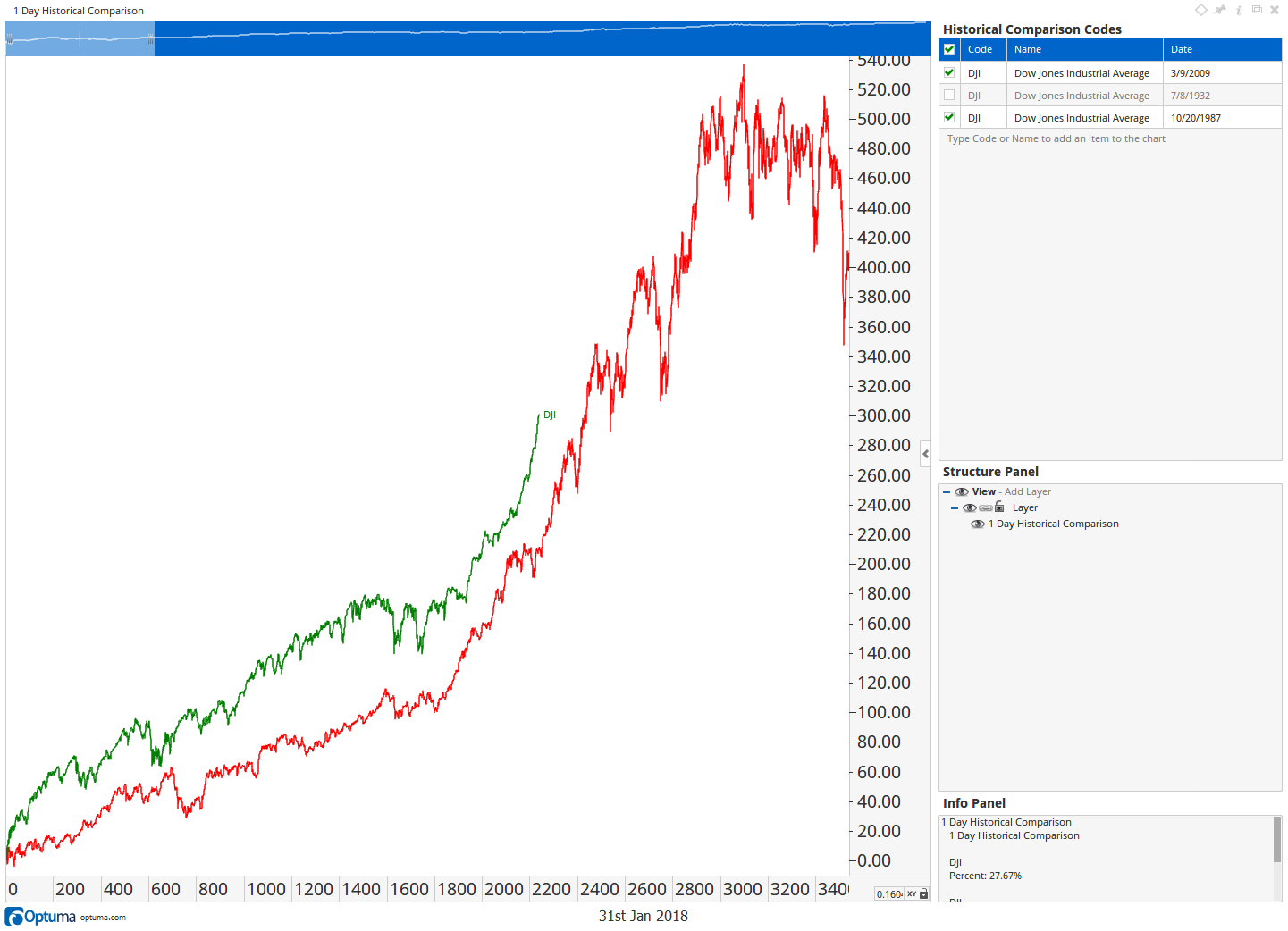

A new chart that we have been working on for the next major release of Optuma (expected Q2) is an Historical Comparison Chart. This one lets us put in multiple securities, or the same security multiple times, and set different start dates for each. We can then compare each of their respective growths from their start date. This is to solve many requests we get for looking at overlays of charts and being able to shift their start dates.

As I was completing a preliminary test of the work (it’s still unfinished), I noticed this chart and just had to share it.

Here I put the Dow in two times with start dates on October 20, 1987 and March 9, 2009 (well actually three, but I’m hiding 1932), as they were the lowest point in the market. My intention was to see how the recoveries compared from the two biggest recent crashes. I was astounded to see how closely they are tracking! Even the biggest corrections seem to be happening around the same time.

This surprised me because 1987 was a short sharp brutal correction and 2009 was the end of an 18 month global financial crisis. Yet there are so many similarities in how the markets have rebounded from each low. The take-away is obvious, if they continue to match, then the Dow is only just over half-way through the bull run!

Historical Comparison Chart

Historical Comparison Chart

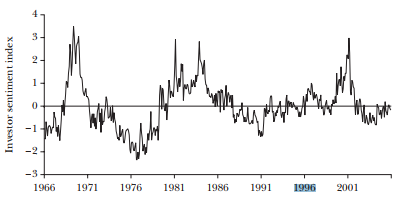

The equivalent period of time, to where we are now, in the 1987 line is 1996, that is, 2018 in green lines up with 1996 in the red line. So I went searching to see what the sentiment was back then. Here are some things I noticed:

Headline from CNN Money in Aug 2017

Headline from CNN Money in Aug 2017

So both periods were a Low Vol rising market.

Investor Sentiment in the Stock Market by Malcolm Baker and Jeffrey Wurgler

Investor Sentiment in the Stock Market by Malcolm Baker and Jeffrey Wurgler

Of course a single case like this is not enough evidence to base investment decisions on in isolation, but since our markets are driven by the psychology of millions of individuals. We often see similar patterns happening as fear, greed, conservatism, regret, and all the other biases take hold. If 1987 truly is a good model to follow, then it looks like there is still a long way to go. This is also a good reminder to stick with the trend until we have a confirmation of a change. Sounds obvious but not easy to do when everyone is telling us that the sky is falling.

Advisory System

Advisory System

Get blog updates and Optuma News