GoNoGo Evidence-Based Investing - Part 6

This sixth and final video in the GoNoGo Charts educational series brings all the concepts together into a ...

For the last few weeks global markets have seen periods of greater than average volatility resulting from several factors including the rise of the Covid-19 virus, stimulus packages in response to the economic impacts of the virus, and an oil war between Russia and Saudi Arabia.

For the last few weeks global markets have seen periods of greater than average volatility resulting from several factors including the rise of the Covid-19 virus, stimulus packages in response to the economic impacts of the virus, and an oil war between Russia and Saudi Arabia.

For the first time since 1997 the US Stock Markets triggered a temporary trading halt, occurring twice after falls of over 7%. Most markets have now entered Bear Market territory and we have seen sensational headlines plastered over the media. What can we expect from here? Should we have been able to see this coming? We want to provide a pragmatic and levelled analysis of the current situation. To do this, we asked a few of our institutional clients a series of questions regarding the current trading environment to get their take on the situation.

Note that these responses were received last week and in times like this the market can move very fast. The responses were valid at the time they were written.

Before we get to the questions, we’ll first give a quick introduction to the three respondents.

A combination of three indicators first caused me to reallocate a portion of my Moderate, Balanced, and Conservative models into bonds, and then to exit the market altogether:

The Feb 24th gap was ugly and unusual—we started taking risk off and by the 25th that was an unusual ATR move by any measure. Volatility stops mostly triggered and cash was raised en masse.

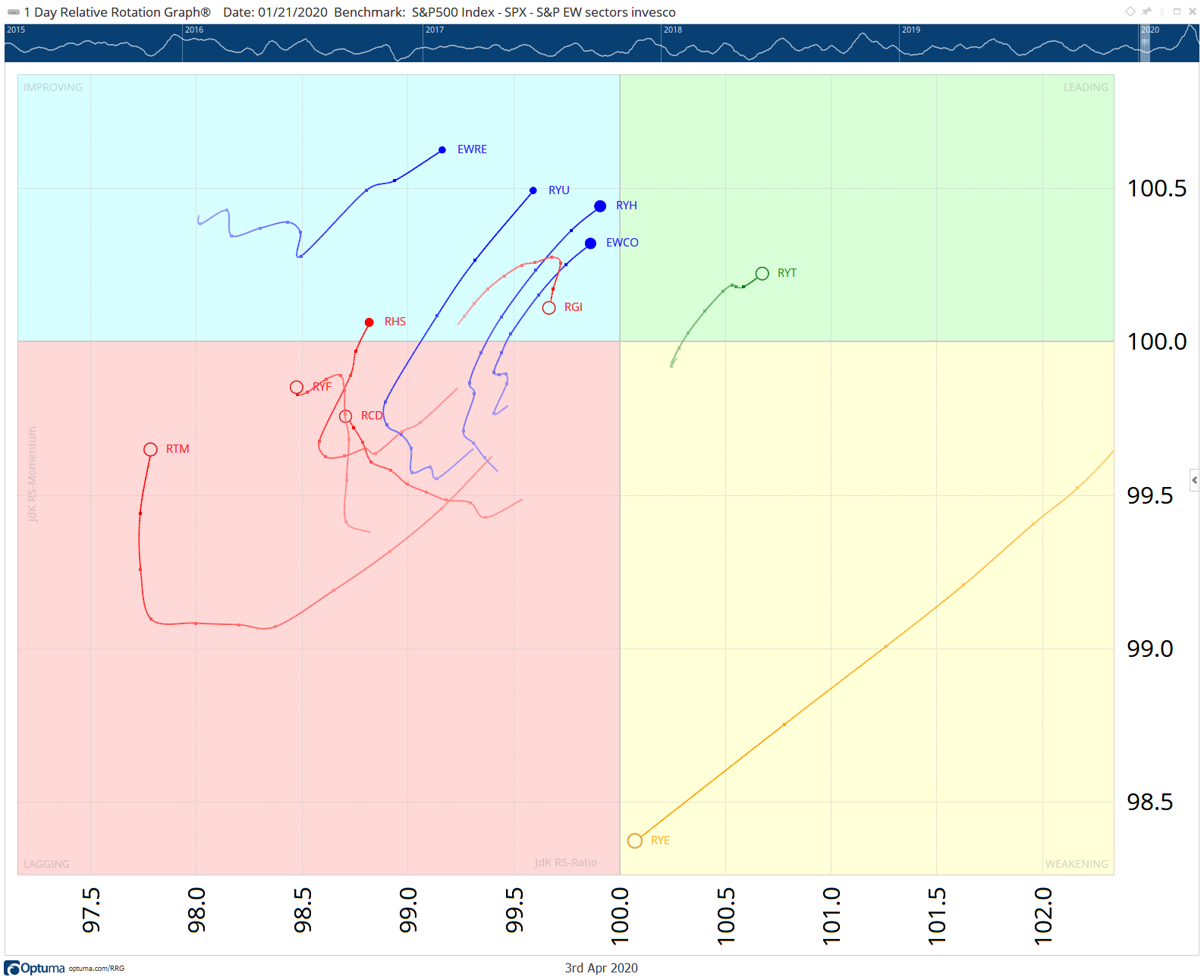

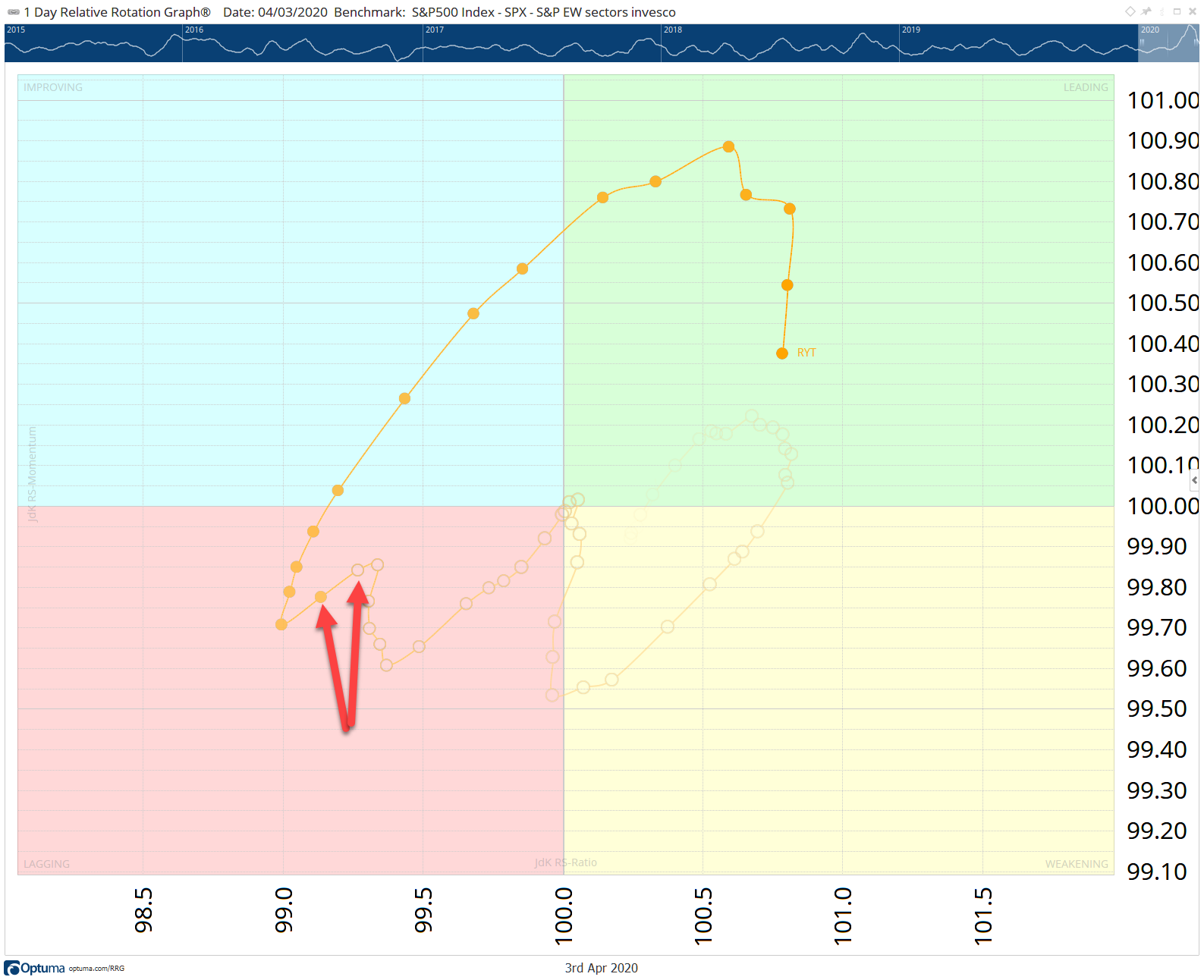

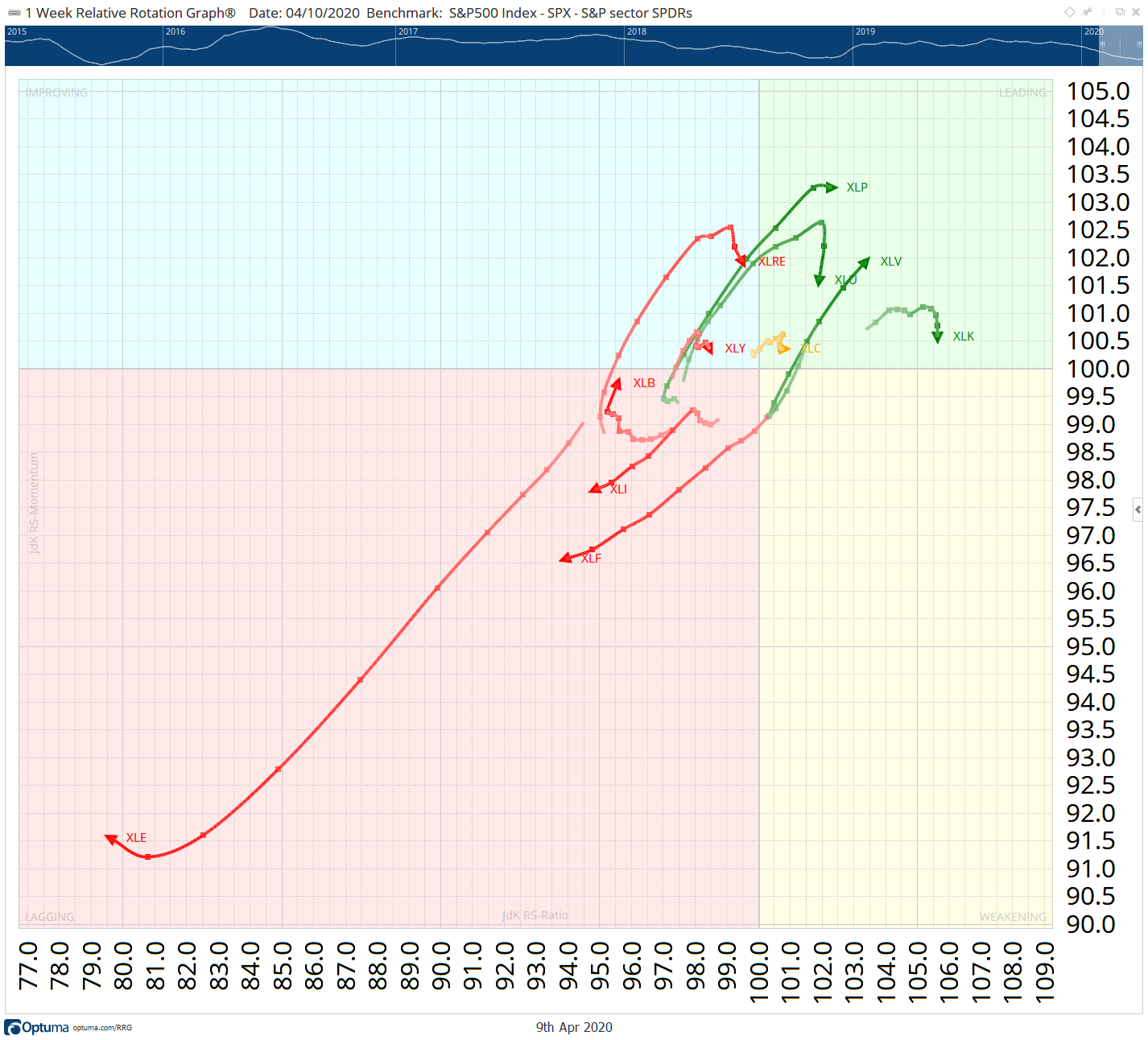

I never estimated such a big move and certainly not as vicious as it came. What I did notice was an improvement underway for “defensive” sectors since mid to late January. Recently I started researching the use of “rolling BETA” to classify sectors as defensive or offensive. In short High BETA (>1) sectors are offensive while low BETA (<1) are considered defensive. In Optuma I scripted the size of the bubbles on an RRG to display the difference of the 12-month rolling BETA from 1. This gives me positive numbers for High- and negative numbers for Low BETA sectors. On the RRG chart these bubbles will either be closed for negative numbers or hollow for positive numbers. In the RRG chart in fig 1 I have applied that to a universe of Equal Weight sector ETFs for the US market.

Note how Low BETA sectors started to rotate towards the leading quadrant at the end of January.

As the move unfolded, these defensive sectors continued further right through the leading quadrant indicating a relative uptrend vs the S&P 500 that continued to get stronger. A few sectors even completed rotations at the right side of the RRG (leading-weakening-leading) indicating a strong relative trend.

When defensive sectors start to lead and rotate at the right-hand side of the RRG, that usually signals weakness for the market as a whole.

One thing that struck me is how Technology became a defensive sector (BETA dropped below 1) on 3/13 as investors flocked into the big tech names looking for safe havens.

No. Although I wish I had a way to “speed things up” when a crisis arises. There have been countless crises in my two-decade career that “looked” just like this one on the front end. My strategy has been tested over bull, bear, and flat markets, so the occasional anomaly is one that I have to accept, understanding that TA and trend-following will protect me and my clients regardless. There is no “perfect” trading strategy.

Take the stops we see and unusual moves in the market are unusual for a reason—it’s better not to ask too many questions, but sell our stocks and adhere to the plan with the idea that we’ll see what comes thereafter. Internet consistency has been a concern amidst this growing virus shutdown and a risk, so we always know how many shares we own. We’re a phone call away from the trading desk—even if our instruments are blind.

Not specifically. Have your stops in place as usual when you are a shorter term trader or have a solid asset allocation process in place which should/would prevent your portfolio from being heavily overweight stocks when risk increases.

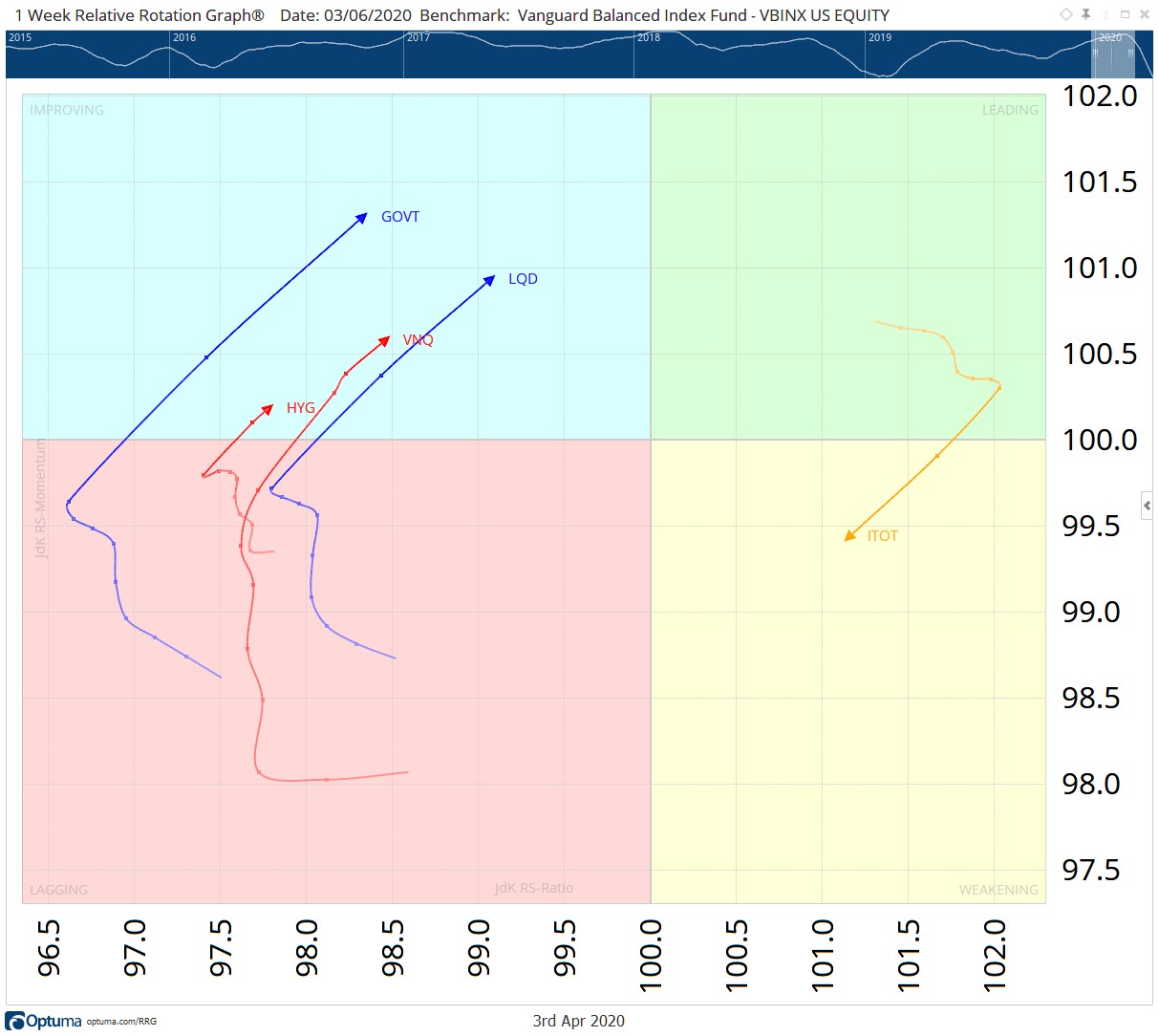

This RRG shows ETFS representing a few major (US) Asset classes. It is using a weekly timeframe so it will react a bit slower than daily. In the week ending 3/6, ITOT (core S&P total stock market) had rolled over and started rotating at a negative RRG-Heading while the risk-OFF asset classes rotated in exactly the opposite direction. Needless to say since then this rotation has continued hard in these directions with one exception for VNQ (Real Estate) which turned around and is now heading deeper into the lagging quadrant together with stocks.

*I have left out commodities as it is so detached from the rest of the asset classes (way to the left inside lagging).

No. I focus on Price, Trend, Momentum, Breadth, and Volume. If I ever use fundamentals, it’s as a compliment to my technical shopping lists when I’m looking for new candidates. Sometimes a tie-breaker, so to speak. But I focus primarily on technicals.

With the rising VIX I can see trouble, and by watching the sectors and industry groups, I can see where investors are concerned. Fundamentals don’t matter and are too slow to be of use. Technicals are sufficient and optimal for making our decisions.

I read it and I use it in the back of my mind basically to “paint a picture”, but it is not part of my process.

No. I plan on scanning through all asset classes, sectors, and industry groups when I get back into the market with no discrimination against any one group, whether it be for fundamental reasons or otherwise.

Energy has been so brutal, it’s an easy avoid. It’s been brutal for years and trending down for about 12 years… so easy to not get caught up with big moves that can happen with little notice. I also don’t like these industries like airlines that are asking for bailouts to move forward. These are tough industries at the best of times. Cruise lines? I think cruising might be dead as a pastime. Those expensive boats and the debt borrowed to build and buy them will probably never get paid back. Reminds me of the shipping industry in ‘08.

All sectors are on my radar and I can keep an eye on them in one single graph ;)

When the leading asset class is U.S. stocks, let’s say… then most of my focus will be on sectors, industry groups, and individual stocks within the U.S. market. I’ll glance at commodities, foreign currencies, and run through my inventories for those categories each week, regardless of the fact that I’m not buying them. However, they wouldn’t get as much attention when U.S. stocks are soaring. So in times like these, I’d say yes, I’m paying closer attention to, spending more time analyzing, and adding more commodity and currency positions to my watch lists, looking for set-ups and potential entry points with good risk/reward potential.

I’ll take high volatility over low any day of the week. Any time the complacent buy and holder struggles, I smile. When “blue-chip” dividend stocks get crushed and financial stocks get pummelled, I keep smiling. Most investors have no plan, but actually buy & hope. My process is the opposite and capable of adapting to all circumstances no matter how historic they might be! Early in the stock sell off, we were long palladium, coffee, and gold because the trends supported it—but with rising volatility and collapsing security pricing, it doesn’t take much to push sell and walk away as things develop.

For my more conservative models, no. But for my aggressive model, as well as a small piece of my moderate growth model, I’ll consider shorter-term indicators in a bear market in order to attempt to enter trades that can create shorter-term profits than I usually would. When in a bear market, even using shorter-term trend-following indicators, such as an 8EMA over 20SMA x-over is too slow. Same goes for price closing below/above the 20SMA…it’s just too big of a lag and the risk is too high when you’re swimming against the current.

I like moving average slopes and following leadership via simple routes like % from highs and following groups at the sector and then industry level. If we can see utilities or technology broadly holding up (for e.g.), we’re interested. Using ATRs tells me if we’re dealing with unusual circumstances, and dynamic ATR stops get me out of stocks quickly even though we might have liked the names the day before or last week. No matter. Securities are risky and no attachment is allowed. They can always be bought back.

Sticking to the same tools, maybe play around with sensitivity settings for RRG rotations in very fast moving markets to get some extra color but the bottomline approach remains the same.

To piggy-back on my response above, yes, for a portion of my more aggressive models, I do “speed up” my analysis to see if there are places we can gain entry into a swing trade in an environment like this. The setups I’m looking for are based out of more traditional technical analysis methods such as bullish momentum divergences, combined with price action that indicates levels of potential support that offer tight stops and thus good risk/reward opportunities. In this kind of market, risk management is paramount. It doesn’t always make sense to “force” trades just to be invested in something. You can turn out to be a failed hero in many cases, so sometimes the best place to be is simply sitting on the sidelines in cash.

Yes, given the magnitude of the selloff, it seems HIGHLY unlikely that we could V-bottom. I was wrong in 2018, but surely after this much damage, it’s highly unlikely. So using Fibonacci retracements can give me levels that risk is no longer worth taking on, and help to establish hedging/selling spots for equity we bought down low into the lows. I would say that I think there is significant long-term (1-2 year) upside, but so much ahead with global economics at a halt and the significance of asset price moves, that there is no way I’d invest on that timeframe. I’d rather trade/invest for the short-term and see what the market brings. All my intermediate-term bottom indicators are flashed (except for a high volume follow through as of today Mar 31/20) day, so risk is back on, even for trend following with a staged buy program. That said, given retracement levels aren’t far away, I’m prepared to put hedges and/or sell quickly if I see reversals and/or selling on volume.

I have no idea. I prefer to let the market dictate its direction, and as a metaphorical “financial surgeon”, my plan is to pay attention to and analyze internals – specifically breadth and momentum – and use my model to determine when it’s time to get back in.

No clue. But with lower lows now on charts like the S&P 500— the uptrend definition is gone. The Nasdaq is a stand out and mostly captures my attention (and investment dollars). I have no clue what this economic shutdown means but presume the earnings and economic numbers are going to look like a disaster for some time. Not to mention the corporate credit mess looking like trouble and seeing liquidity freeze up in some of the hedge fund and real estate markets reminds me of 2008. Lots of things are possible. Lower asset prices yet is certainly one of those things!

I have absolutely no idea and hence not looking for a specific date or price. With regard to S&P 500 (stock market) I am probably watching the same long-term horizontal support levels as everybody else but that’s about it.

Have a plan and decide on your timeframe. I can take short-term trades, because I’m comfortable, have a process and know how I’m going to manage the risk. Small losses are essential—NEVER risk too much on a trade, i.e., < 1% of your account or -8% from cost based on a given stock or security. It avoids the blow ups and avoids the challenges associated with trying to deal with bleeding positions or crashing markets, or dividend cuts or credit downgrades, you name it! Invest in the direction of the trend only. If you want your portfolio to rise, ONLY invest in things that are rising and if nothing is rising, so be it—stand aside. No shame in observing. If results aren’t working out well, shrink your size, make fewer decisions and paper trade until you can get back to be comfortable. If a particular trade style isn’t working—do less of it—always do more of what is working and less of what is not.

If you have a process in place, stick with it. These are the times when the work that you did to put the process together pays off. If you didn’t have a process going into this volatile period, it may be better to refrain from trading and spend your time to get a process in order that you can start to operate when markets have, at least a little bit, calmed down.

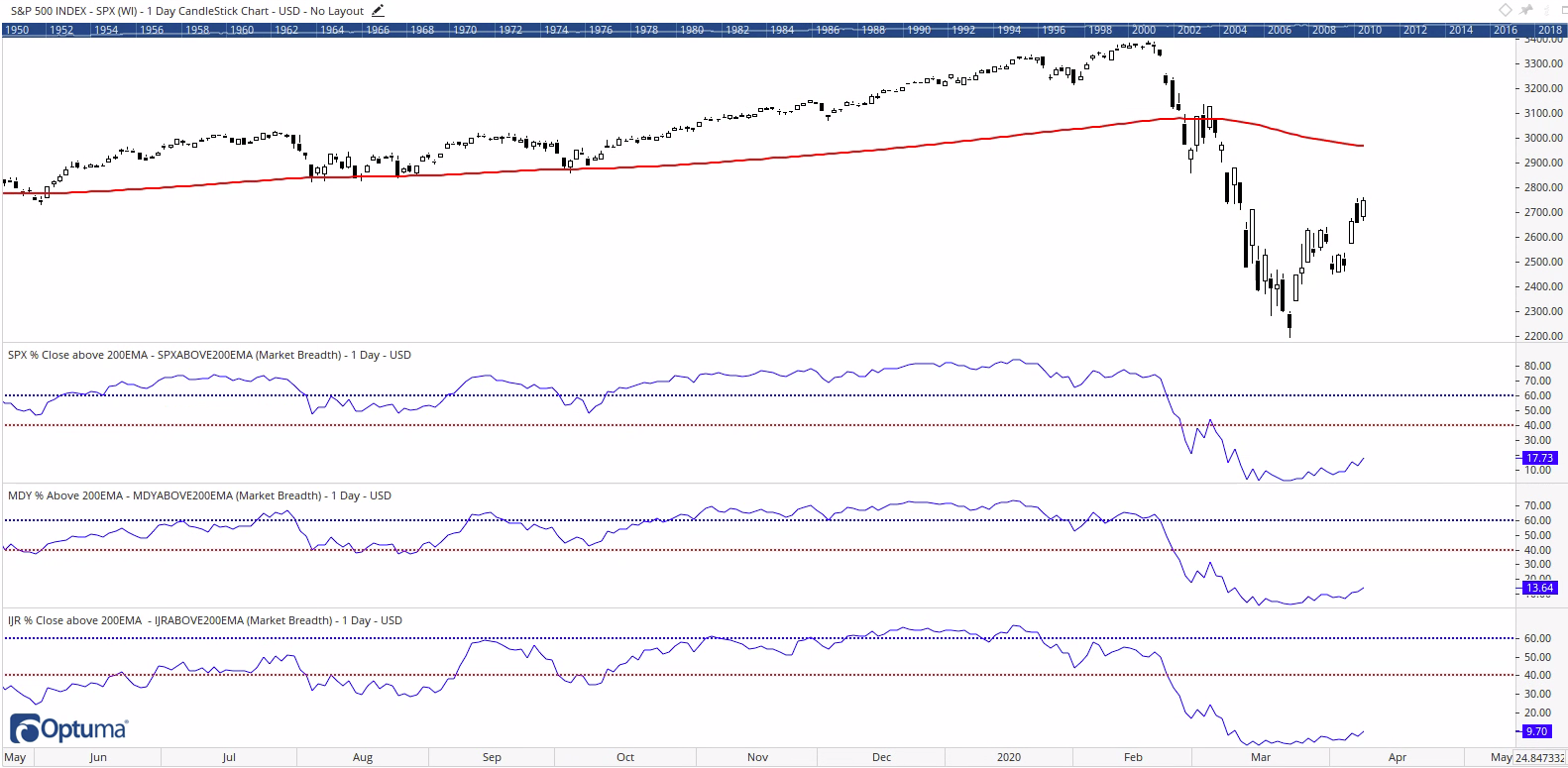

Wow… I look at a lot of charts every day, but if I were to pick one that I keep referring back to every day, it’s the chart below. What we’re looking at here is the S&P500 in the upper pane, followed by the following three indicators:

This is one of the many indicators I use to determine whether or not the market is healthy enough to start deploying cash back into stocks. My time frame is intermediate term in nature, so I’m looking at 3-9 months or so, if I had to pick a “range.” So as I analyze the chart below, if at least two of the three indicators below were to cross above 60%, this would be one piece of evidence (amongst several others I’m watching) that could indicate we’re seeing a a completion of the bottoming process in stock market today.

As you clearly see, as of 4/8/2020, large caps sit at only 17.73%, mid caps reside at the 13.64% level, and only 9.70% of small cap stocks are above their 200EMA. Pretty dismal, so patience is key here.

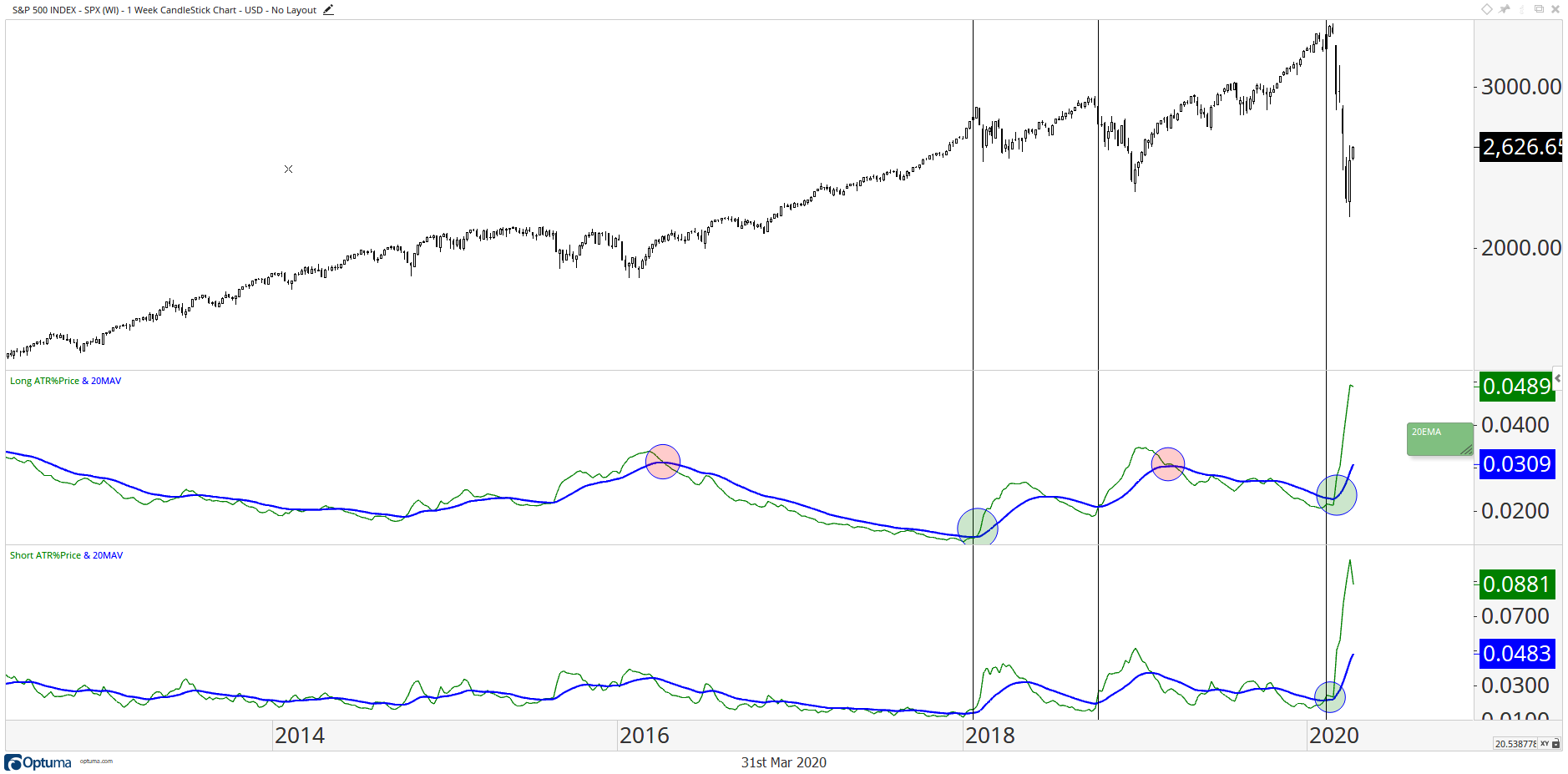

Chart 1: Sure, I like watching ATR’s on the market and this S&P 500 chart has both a long ATR%Price w/ 20MAV (defined as weekly ATR(20)/MA(20) in the middle panel and a shorter-term version ATR(5)/MA(50). When these indicators climb above their respective 20EMA—we have to be careful. Note the vertical lines when that lower panel 20EMA slope turns up. It tends to preface equity market trouble. gives you an early warning signal.

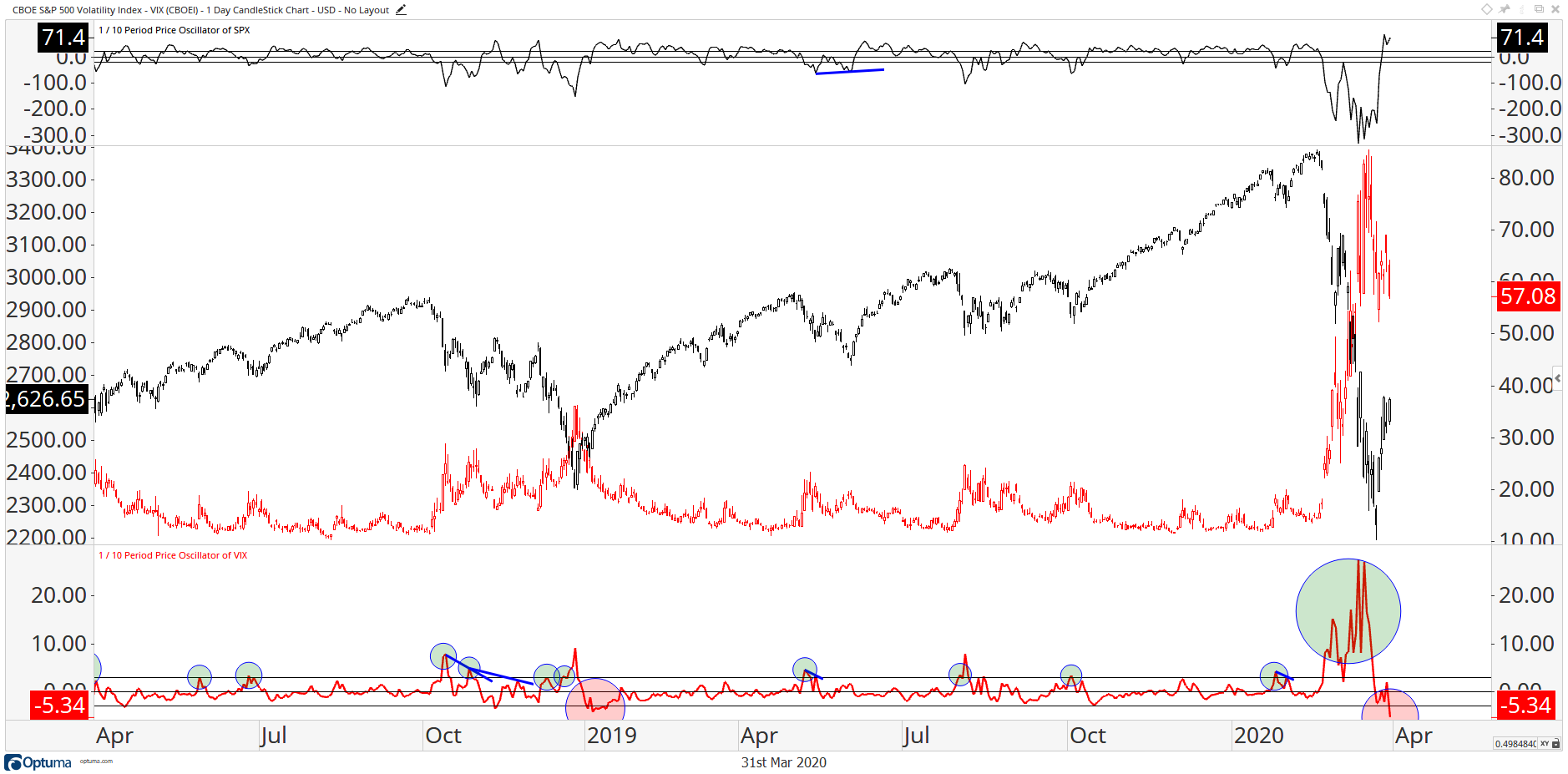

Chart 2: I love this S&P 500 vs. VIX model— the black middle series is SPX, the red middle series is VIX. Both the 1/10 price oscillators are respectively above and below. When that lower panel 1/10 VIX goes above that horizontal line ~3 we tend to have an equity pullback in place putting me on buy alert. When it settles, the signal fires (green circles)—this last one set a record for 3 higher highs as volatility surged (last green circle)! It eventually fired an equity signal, but continued to keep me on alert. The VIX can and should do that. Volatile times we’ve been living in. We’re now settling and in fact just went below that lower horizontal line, which tends to represent long-term equity entry points (see the last one in early 2019). I have my lower line at -3.

Seriously..? You are asking me what my favorite chart is ;)

No doubt. A Relative Rotation Graph, probably showing US sectors. That’s by far the most used universe on an RRG!

We hope that you have been able to glean some helpful information from the responses from these professional fund managers/advisors. A key takeaway from them all is the importance of a plan and then sticking to it.

Get blog updates and Optuma News