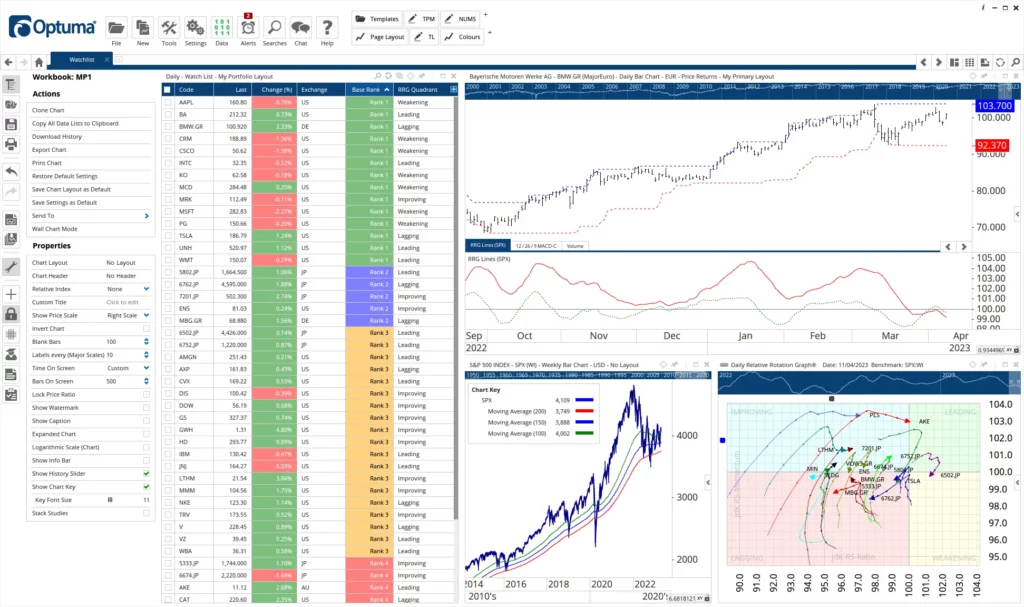

Save time. Simplify your workflow. See new opportunities.

Eliminate repetitive tasks with personalised watchlists and layouts

Gain new perspectives on the market with advanced charts and features

Customisable software so you can focus on what matters to you

Our expert support team is always available to provide the assistance you need to succeed

Take the limits off your analysis with Optuma’s unlimited charts and alerts.

Access the most advanced tools available to see new opportunities.

Advanced and secure software designed for institutional analysts, traders, and portfolio managers.

I tried Optuma as part of their offering for CMT candidates, and I quickly learned the difference between retail solutions and professional software designed by technicians, for technicians. For practitioners, CMTs, or those who trade professionally, I can’t imagine using another platform. As someone who has tried them all, there is really nothing comparable.

Tarek Saab Founder, Fibonacci.com

Having a subscription to Optuma is like having a young, incredibly intelligent, malleable human mind, combined with computer processing power at your fingertips. It’s as if when you login for the very first time, a computer genius welcomes you at the door and asks, “What would you like to do?” …and, at least for me, Optuma can do virtually anything.

Adam Koos President / Portfolio Manager, Libertas Wealth Management Group Inc

Technicals are all about visualizing data and Optuma clearly has the most advanced graphics of all technical platforms. The use of “layers” allows a user to organize and manipulate data in ways that are impossible with other software programs. I use this product every day to help manage various portfolios and I encourage everyone to try it out.

Kyle Crystal, CMT Portfolio Manager, Crystal Capital Advisors, LLCIf you’re taking the CMT exams, Optuma’s CMT courses are a must do. Designed to be mindful of your schedule while delivering all the information you need to pass your exam.

Courses to help you master the software and grow your skills in market analysis.

Advanced courses from our partners to help you expand your knowledge and abilities.

Articles on the state of markets, analytical strategies, and updates to Optuma.

Copyright 2024 © Optuma Pty Ltd

Level 9, 110 Eagle Street, BRISBANE QLD 4000, AUSTRALIA

ABN 41 628 890 095

Optuma continues to blow me away. Feature after feature astounds me…i.e. the ability to highlight numerous tools/lines/etc and make it a quick button up top is crazy. Multi time frame analysis with different periods/averages on the same chart… multi currency – wow. Flexibility to deal with multiple markets at the same time…. you guys don’t need to give me more reasons to love this thing!

David Cox, CFA, CMT, FCSI, FMA, BMath Portfolio Manager, CIBC Wood Gundy